The fast developing fintech industry offers a great variety of solutions for Managerial Accounting for both big enterprises and small companies. Generally, big enterprises require a multifunctional cumbersome solution for their accounting, finance and audit departments. Whereas small companies need a simple software solution to be managed by a business owner with entry-level accounting skills. Small and mid-level companies use almost identical set of financial transactions: revenue, cost of production, tax payments, administrative cost, fees. Basically any business uses this same set of transactions.

The team of this project has a distinguishable vision of a project-oriented business. This type of business is peculiar in the sense that each transaction should be backed by a certain project, or its milestone, or a task, with deadlines, employees hourly pay, subcontractors hourly pay, project metrics, all of which rely on financial transactions and other aspects of project-oriented companies.

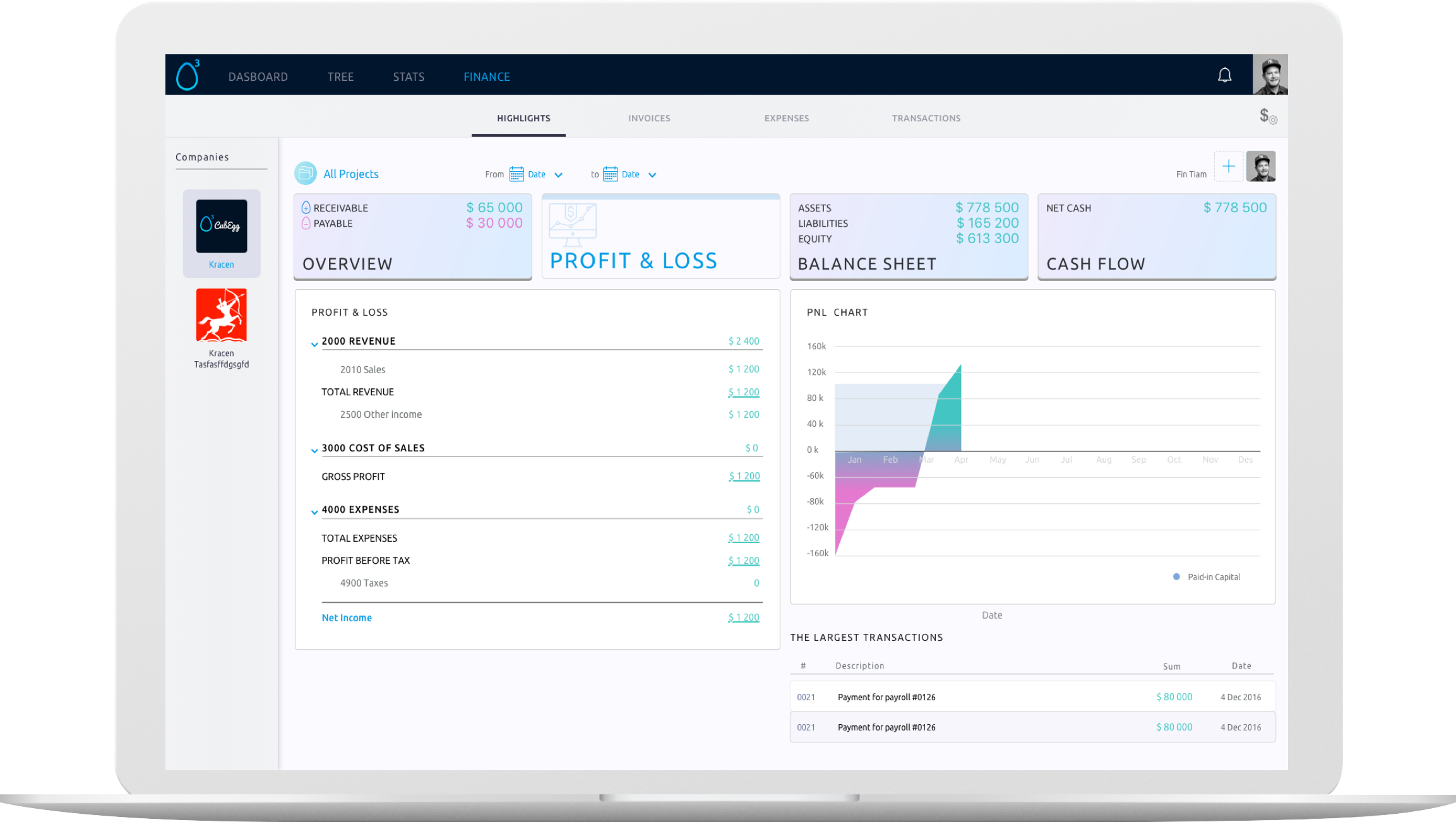

The project development team aimed to simplify the balancing of the basic financial statements (Balance Sheet, Profit and Loss and Cash Flow Statement) and completely spare the users from the Spread Sheets they yet have to create on a daily basis.

The IFRS were developed by the International Accounting Standards Board (IASB) as a single set of high quality, understandable and enforceable global accounting standards that could serve as a model on which businesses base their own requirements.

The project development team was committed to create a system that would be compatible with the IFRS standards, to let users of the system work within the globally accepted reporting format and accounting rules.

To accomplish this goal the team invited a certified consultant, and together with the project manager and business analyst they have developed the basic accounting model. This model covered the widest range of businesses of project-oriented companies. This model also provided easy customization rules for clients with special requirements.

Keeping track of financial metrics is a significant part of project-oriented businesses. The convenient way to do that is to track them by each particular project, even by work stages of a project, called milestones. And like in any other industry, performance rates monitoring should also be conducted at the level of departments, teams and an entire company. The hierarchy structure of the financial metrics relies on the Cubegg.com project management model. In this model the smallest reporting unit is a task, which is always assigned to a milestone, which is consecutively assigned to a project, a team, a department, and so on. Hence, financial documents can be easily created based upon a task, and for users with less detailing needs the documents can be created based upon a milestone or a project. Cubegg.com can register the time spent on a task, so that expenses and revenue can be easily related to actual time spent, or total cost of a task. This approach routinized accounting for most service providers and project-oriented companies.

The following hierarchical tree was embedded into the core of the system:

and every transaction is associated with one of the nodes of this tree.

Whereas IFRS suggests the basic universal package with such reports as Revenue, Expenses, Assets, Liabilities, etc. Each transaction record relies upon these two parallel trees, and it allows flexibly tracking different business aspects.

Users can configure Chart of Financial Accounts to suit their requirements, however, the basic package of the system is more than adequate for an average small business.

The cornerstone of financial system is reporting, since we base the system on IFRS, we studied their recommendations regarding reporting. IFRS foundation requires the following set of reports:

We singled out the most essential reports for the users: Balance sheet, Statement of comprehensive income and Cash flow statement. There reports visualize a company’s financial standing not overstuffed with excess detailing.

The mentioned hierarchy structure allows filtering the three reports by any business aspect and overview company performance at any moment.

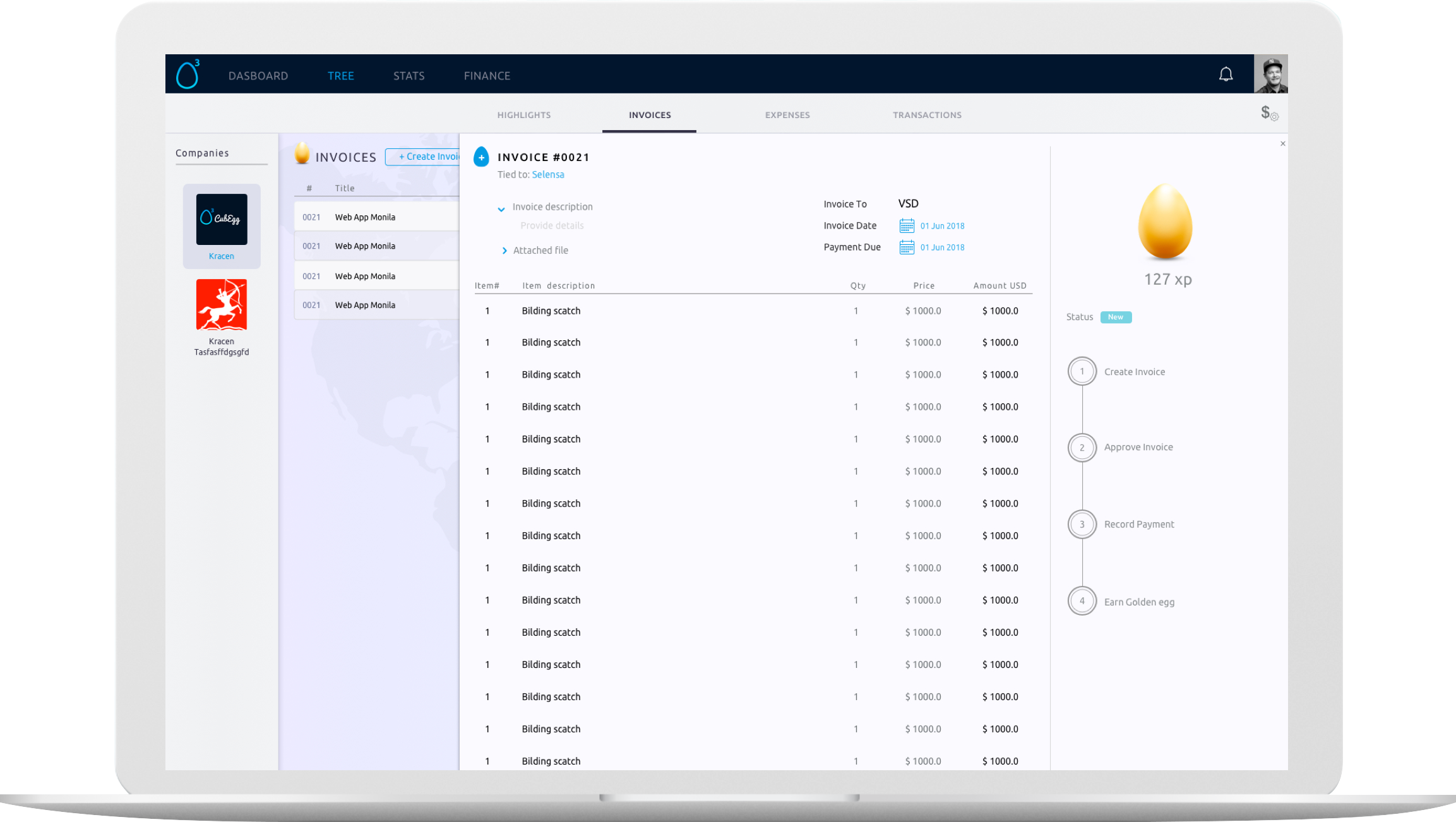

The gamificated approach to create routine documents was implemented. It expresses our vision of the daily accounting process.

For example, Invoice is a very important financial document but creating a new document every time can eventually get boring. But you can turn this mundane work into a step-by-step game with awards. Along with user-friendly design the work of your responsible employees can become fun.

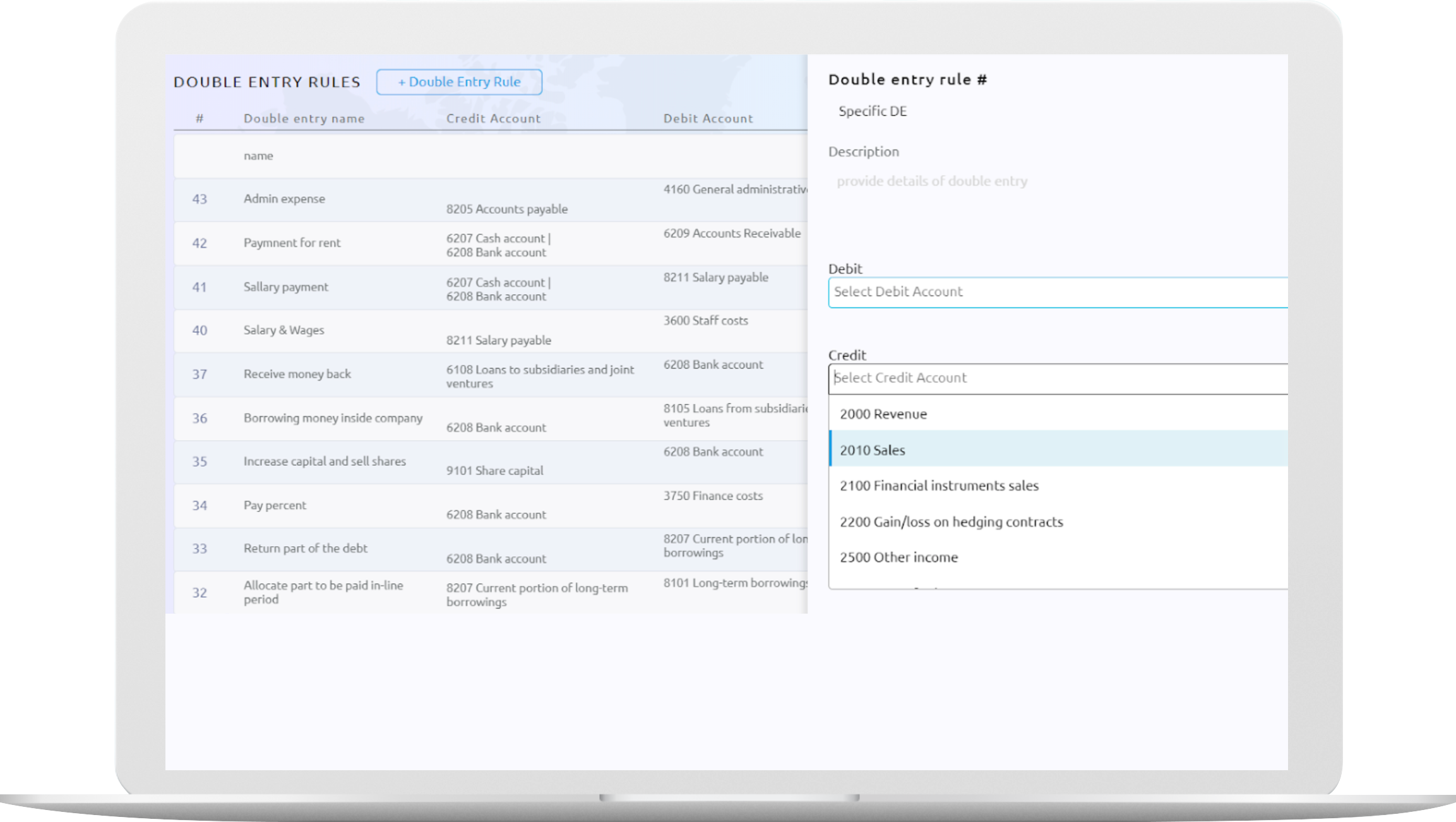

Financial documents are based on the Double Entry Rules, the templates of which are accurately saved in the system. Just like the invoice tree, the templates covers the majority of business processes.

If a user wants some specific Double Entries and can’t find the template in the templates list, he can create a new template and add it to the system.

It’s basically a convenient accounting tool for general users, but also a fully-featured financial tool with flexible settings for more advanced users.

The philosophy of the project is this: fun, gamification and ease of use. It’s one of the prime points that makes this brand so distinctively different from its business rivals. The project was inspired by the console and online video games. And it combined the best features of existing SaaS accounting solutions for small businesses on the USA & Europe markets to create an ergonomic environment for accountants and financiers.